Which of the Following Is an Advantage of Leasing

Unlimited mileage on the car C. Leasing may have favorable tax advantages.

Solved Chapter 8 Problem 2 Big Sky Hospital Solutionzip Hospital Plans Big Sky Hospital

All of the following have been cited as advantages of leasing by small businesses except.

. You pay only for the bandwidth you require. Leasing permits the write-off of the full cost of the assets. Which of the following would be an advantage of leasing a vehicle.

P 264 which of the following would be an advantage of. They are good at developing innovative contracts that help avoid accounting problems. Depreciation is deductible from income.

Which of the following is an advantage of leasing. Leasing offers flexibility and lower costs when disposing of an asset. Up front costs may be less.

Which of the following is an advantage of leasing a frame relay circuit over leasing a dedicated circuit. The provisions of the agreement may be less stringent than for other debt agreements. Lease payments often are lower than installment payments.

The biggest advantage of leasing is that cash outflow or payments related to leasing are spread out over several years hence saving the burden of one-time significant cash payments. Taxes may be reduced by leasing. One of the things that would be an advantage of leasing a vehicle is.

Which of the following is an advantage of leasing from a lessees perspective. The lessor can claim tax relief by way of depreciation. All of the other answer choices are correct.

Less cash required up front b. Automatic ownership interest in the car B. The lessor acting prudently can make high profits from leasing of the asset.

Interest rates for leasing are always lower. Asked Feb 10 2019 in Computer Science Information Technology by Localizer. 2 Automatic ownership interest in the car Unlimited mileage on the car No need to meet credit requirements Lease payments are likely to be lower than finance payments.

You are guaranteed to receive the maximum amount of bandwidth specified in the circuit contract b. The lessor can repossess the leased equipment where the lessee defaults on payments. The lessor may use the funds for other investment opportunities.

The firm may be able to lease the asset when it does not have the credit capacity to purchase the asset. The profits will take care of his cost of capital as well as the risk involved. A Protection against obsolescence.

Leasing may offer protection against the risk of declining asset values. No need to meet credit requirements D. Leasing is a source of 100 financing for an asset.

C Lease agreements may contain less restrictive provisions than other debt agreements. All of the other answers are advantages Blooms. Lower effective interest costs relative to borrowing d.

So the lessor interest is fully secured. All of these answer choices are correct. Maximum claim of the lessor in the event of bankruptcy is ten years of lease payments.

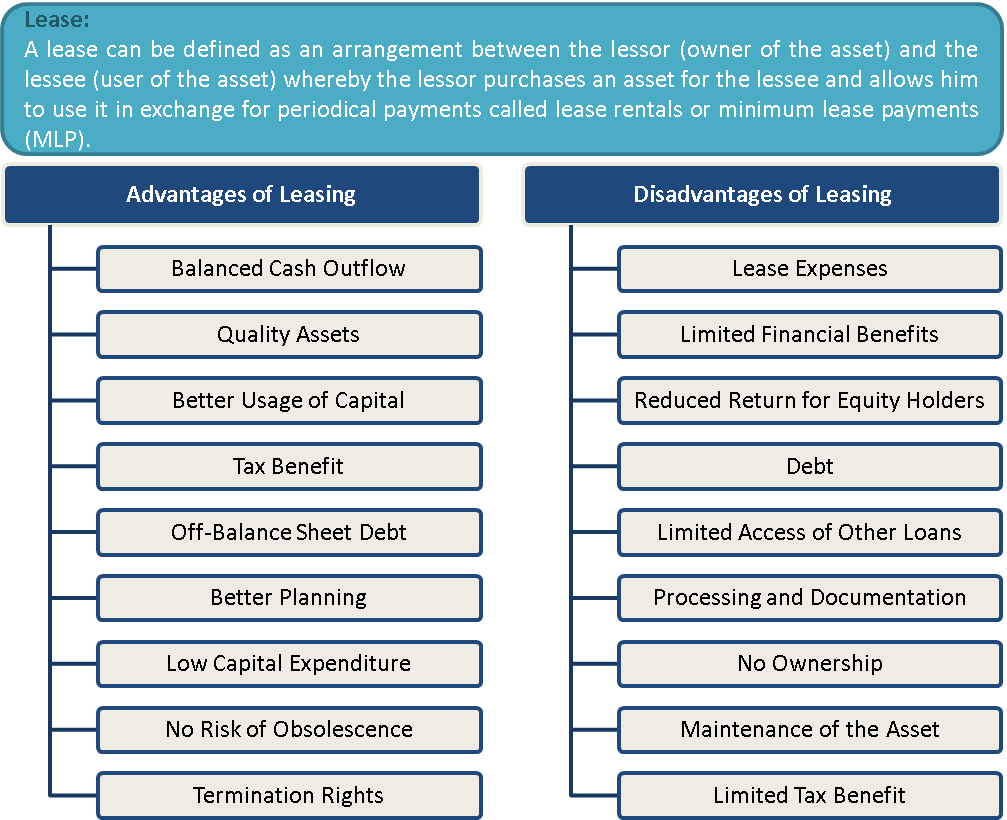

Balanced Cash Outflow. Net advantage to leasing NAL refers to the total monetary savings that would result from a person or a business choosing to lease. They have access to low-cost funds allowing them to purchase assets at lower cost.

Leasing may encumber fewer assets than borrowing. All of the following are advantages of leasing except. Which of the following is an advantage of captive leasing companies over the other players in the leasing market.

264 Which of the following would be an advantage of leasing a vehicle. Which of the following is an advantage of leasing. Lease agreements may contain less restrictive provisions than other debt agreements.

This helps a business to maintain a steady cash-flow profile. Leasing may have favorable tax advantages. Interest rates for leasing are always lower.

Leasing transfers uncertainty about the future value of the leased asset to the lessor. 14 Good reasons for leasing include all of the following EXCEPT that. Which of the following is an advantage of captive leasing companies over the other players in the leasing market.

Advantages or benefits of leasing to lessor. Interest rates for leasing always lower. Maximum claim of the lessor in the event of bankruptcy is three years of lease payments.

B Leases often do not require any down payment. The lessor being the owner of the asset can claim various tax benefits such as depreciation investment allowance etc. Which of the following is not an advantage of leasing as a form of financing.

Leasing permits the write-off of the full cost of the assets. Leasing may permit more rapid changes in equipment. Prohibition on leasehold improvements B.

Leases often do not require any down payment. The following advantages are available to the lessor. Leasing may permit more rapid changes in equipment.

Terms in this set 29 All of the following are advantages of leasing except. Leasing may not increase a firms financial leverage. Administration costs may be lower for a lease than for a straight loan.

Quicker approvals from lessors than from lenders. They have access to low-cost funds allowing them to purchase assets at lower cost. The return to the lessor may be higher than for a straight loan.

Since a transfer of ownership does not necessarily happen in a lease agreement you could get an item from leasing lower than getting it from finance payment. The return to the lessor is quite high. Fewer restrictive covenants from lessor than lenders c.

Lease payment are likely to be lower than finance payment. Leasing permits the write-off of the full cost of the assets leasing may permit more rapid changes in equipment. Advantages of Leasing to the Lessor.

Leasing may have favorable tax advantages. Leasing has a relatively low default risk. Lease payments are likely to be lower than loan payments E.

They are good at developing innovative contracts.

Rental Property Owner Management Kit Rental Owner Printable Etsy Being A Landlord Rental Property Rental

Lease Vs Rent What S The Difference And What S Best For You

8 Tips For Leasing Land For Events Lease Horse Care Outdoor Events

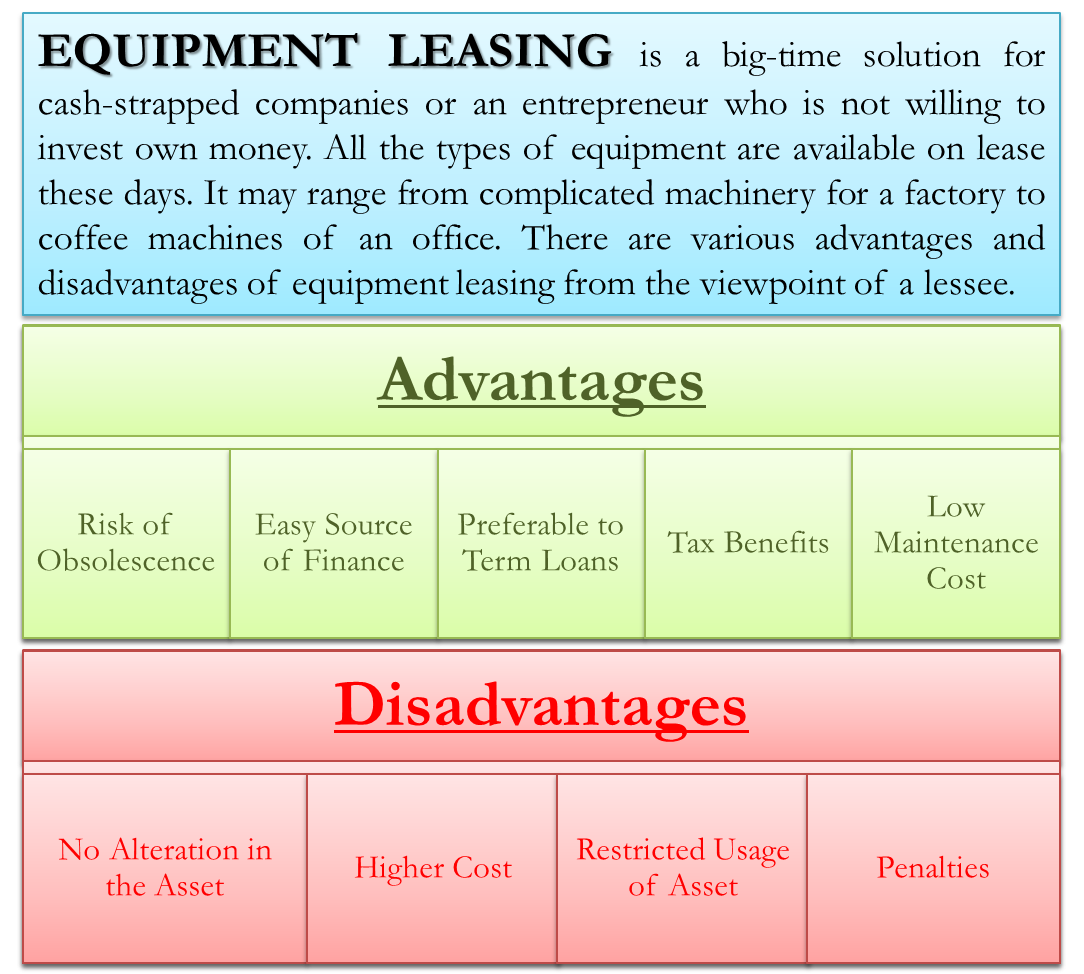

What Is Leasing Advantages And Disadvantages Efinancemanagement

Sample Texas Residential Lease Agreement Printable Lease Agreement Rental Agreement Templates Lease

Pdf Lease Financing Types Advantages And Disadvantages Example

-A-Guide-for-Tech-Com/Tech_Lease-Accounting-Guide_brochure_10-18_webcharts1.png.aspx)

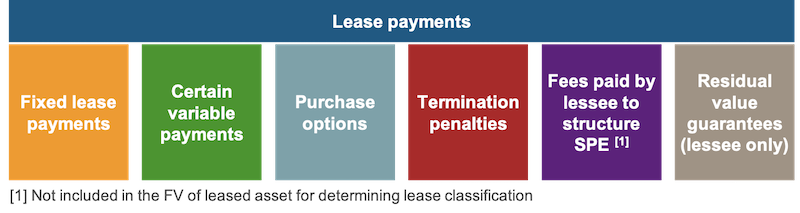

Lease Accounting A Guide For Tech Companies Bdo Insights

Land Lease Proposal Letter Template Google Docs Word Apple Pages Template Net Proposal Letter Lettering Words

Obtaining Succession Certificate Legal Practitioner Certificate Certificate Holder

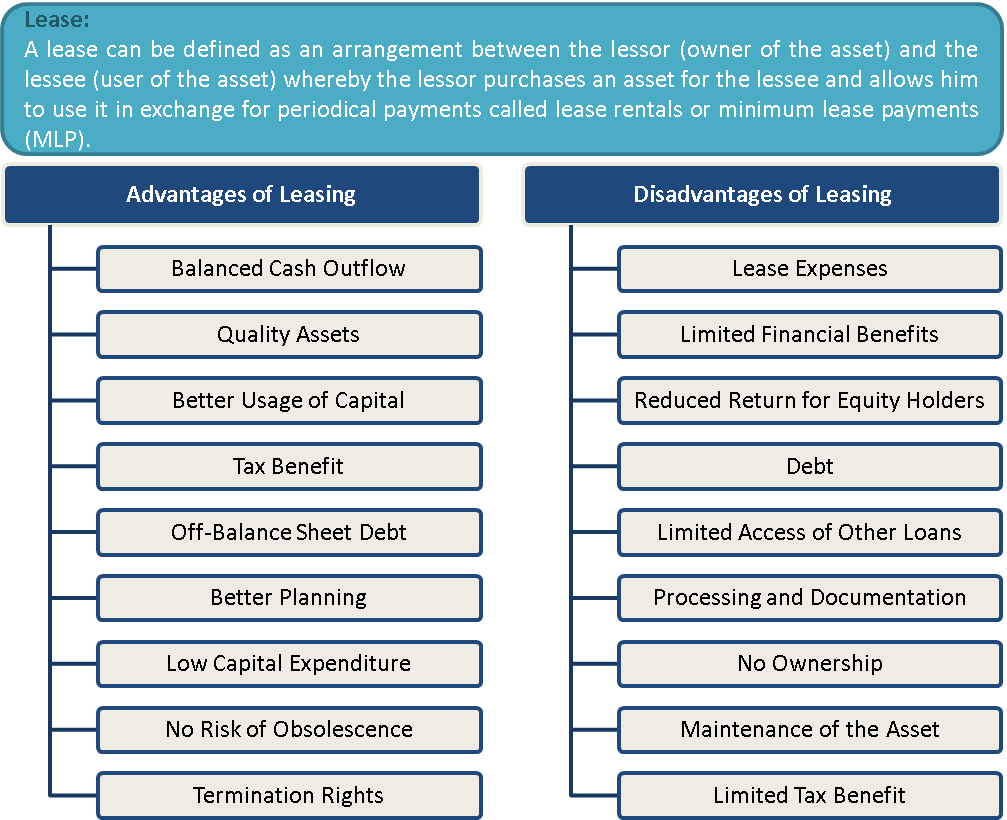

Ifrs 16 Vs Asc 842 How To Account For Low Value Leases Gaap Dynamics

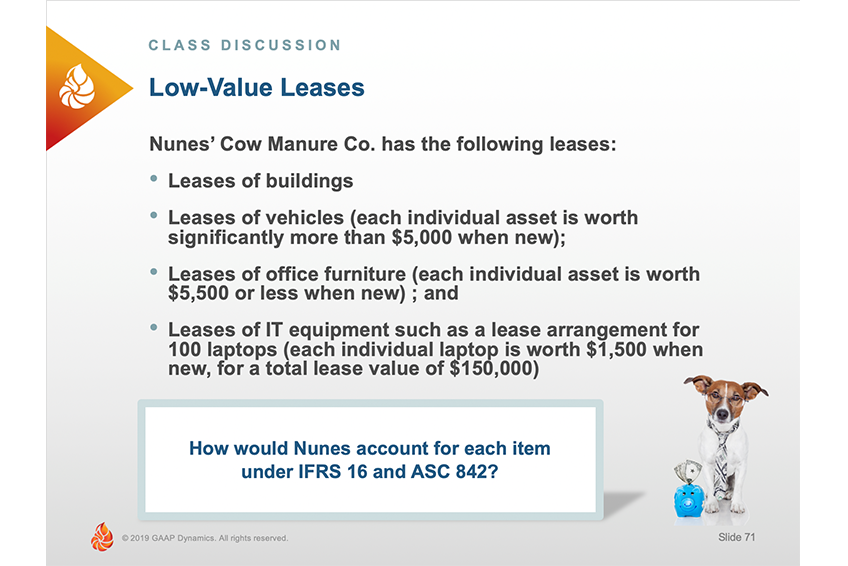

Capital Lease Vs Operating Lease What You Need To Know

Easy To Edit Short Term Rental Agreement Microsoft Word Etsy Rental Agreement Templates Lease Agreement Being A Landlord

3 Questions Physicians Must Ask Before Leasing Medical Office Space Medical Office Office Space Lease

Advantages And Disadvantages Of Equipment Leasing Efm

Cloud Computing Basic Concepts Cyberlibrary Socialmedia Biblioteca Bibliotecas Linkedin Privacy Policy Library Libraries Book Books Livros Livr

Beat Lease Contract Check More At Https Nationalgriefawarenessday Com 50425 Beat Lease Contract Contract Template Lease Agreement Rental Agreement Templates

Marketing Executive Qatar Job Openings Job Opening Job Marketing

Best Zero Down Auto Lease Get The Car Deals At Zero Down Payment Car Lease Car Deals Car

Comments

Post a Comment